OSHA Increases Penalty Amounts

Per OSHA (Occupational Safety & Health Administration), the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015 (Inflation Adjustment Act) requires the Department to annually adjust its civil monetary penalty levels for inflation no later than January 15 of each year. Adjustments are made by issuing a final rule that is effective on its date of publication in the Federal Register.

Due to a lapse in appropriations funding for certain government agencies, including the Office of the Federal Register, publication of the Department of Labor Final Civil Penalties Inflation Adjustment Act Annual Adjustment for 2019 Final Rule has been delayed. The Department of Labor is making the pre-published version of the Final Rule available on its website for informational purposes only until the official version is published in the Federal Register. The unofficial version of the Final Rule is subject to review and revision by the Office of the Federal Register. The Final Rule will not go into effect until it is published in the Federal Register. The effective date will be the date of publication, and the increased penalty levels will apply to any penalties assessed after the effective date of the increase. After publication, the Final Rule can be accessed through the Federal Register website at www.federalregister.gov. To the extent that there are discrepancies between this unofficial version and the official version published in the Federal Register, the latter version controls.

Department of Labor Federal Civil Penalties Inflation Adjustment Act Annual Adjustments for 2019

Department of Labor Federal Civil Penalties Inflation Adjustment Act Annual Adjustments for 2018

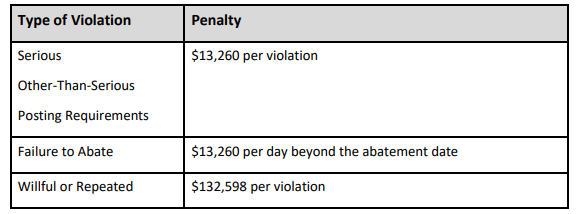

Below are the adjusted maximum penalty amounts that will take effect in 2019 upon publication in the Federal Register.

For compliance assistance, please contact Ryan Wilson at (800) 296-5722 x3740 or [email protected].

Last Updated: Januaury 2019

Source: OSHA

While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information contained herein or for the consequences of any reliance placed upon it. This publication is distributed with the understanding that the publisher is not engaged in rendering legal, accounting or other professional advice or services. Readers should always seek professional advice before entering into any commitments.